What American Seniors Need to Know

When considering retirement abroad, healthcare consistently ranks as the top concern for American seniors. After all, quality medical care is non-negotiable, especially as we age. The good news? Many countries popular with American retirees offer excellent and affordable healthcare abroad at a fraction of U.S. costs.

As someone who has navigated international healthcare systems, I’ve seen firsthand how understanding your options can transform retirement planning. This guide will walk you through everything you need to know about accessing quality, affordable healthcare abroad.

Medicare Options for Expatriates: What You Need to Know

Original Medicare Limitations

Standard Medicare (Parts A and B) generally does not cover healthcare outside the United States except in very limited circumstances:

- You’re in the U.S. when a medical emergency occurs, and a foreign hospital is closer than the nearest U.S. facility

- You’re traveling through Canada between Alaska and another state when a medical emergency occurs

- You live in the U.S. and a foreign hospital is closer to your home than the nearest U.S. hospital that can treat your condition

Medicare Advantage International Coverage

An important option many expatriates leverage is enrolling in Medicare Advantage plans (Part C) that include worldwide coverage:

- Coverage Scope: Many Medicare Advantage plans from carriers like Aetna, Kaiser Permanente, and UnitedHealthcare provide emergency and urgent care coverage worldwide

- Payment Process: Most plans require upfront payment followed by reimbursement, though some facilities in popular expatriate destinations like Mexico and Panama now have direct billing arrangements

- Coverage Structure: These plans typically apply the same copayments, coinsurance, and out-of-pocket maximums that would apply domestically, without specific dollar limits for international care

- Time Considerations: You must maintain a U.S. address in the plan’s service area to qualify

Medigap Foreign Travel Emergency Coverage

Medigap (Medicare Supplement) plans C, D, F, G, M, and N offer limited foreign travel emergency coverage:

- Coverage only for the first 60 days of each trip

- $250 annual deductible

- 80% coverage of emergency care costs

- $50,000 lifetime maximum

- More restrictive than Medicare Advantage international coverage

Strategic Medicare Planning for Expatriates

Many retirees living abroad adopt a hybrid approach:

- Maintain a Medicare Advantage plan with international coverage for emergencies and unexpected health issues

- Pay out-of-pocket for routine care abroad, which is often very affordable

- Schedule annual check-ups and predictable care during periodic visits to the U.S.

- Combine with local private insurance or national healthcare system membership for comprehensive coverage

Should You Keep Medicare While Living Abroad?

Medicare Part A (hospital insurance) is premium-free for most beneficiaries, so there’s no reason to drop it. It will be available if you return to the U.S. for care.

Medicare Part B (medical insurance) requires paying a monthly premium ($185 in 2025). Consider:

- If you drop Part B while abroad, you’ll face a 10% permanent premium increase for each 12-month period you could have had Part B but didn’t when you re-enroll

- If you plan to return to the U.S. frequently for care or might move back permanently, keeping Part B may make sense

- If you’re committed to a permanent move abroad, dropping Part B could save you thousands in premiums

This is a personal decision based on your specific circumstances, health needs, and long-term plans.

Affordable Healthcare Abroad Options for American Expatriates

1. National Healthcare Systems

Portugal

- Servico Nacional de Saude (SNS) provides universal coverage

- Legal residents can access after obtaining residency

- Small co-pays for most services (€5-20 for doctor visits)

- Private insurance still recommended for faster access to specialists

Spain

- Sistema Nacional de Salud offers comprehensive coverage

- Legal residents contribute through social security payments

- Excellent public hospitals and clinics

- Prescription medications heavily subsidized

Mexico

- Instituto Mexicano del Seguro Social (IMSS) available to legal residents

- Annual fee of approximately $500 for comprehensive coverage

- No pre-existing condition exclusions after waiting periods

- Some limitations on facility choice

Panama

- Caja de Seguro Social available to residents with Pensionado visas

- Heavily discounted medical services

- Quality varies by location, with best facilities in Panama City

- Many retirees combine with private insurance

2. Private International Health Insurance

For those wanting more comprehensive coverage:

- Global Coverage Plans: Companies like Cigna Global, GeoBlue, and Allianz offer plans specifically designed for expatriates

- Cost Range: $100-400 monthly depending on age, coverage level, and deductible

- Benefits: Coverage in multiple countries, including evacuation services

- Considerations: Age restrictions may apply; pre-existing conditions may be excluded

3. Local Private Insurance

Often the most cost-effective affordable healthcare abroad option:

- Country-Specific Plans: Local insurance companies offer plans designed for the local healthcare system

- Cost Advantage: Often 50-70% less expensive than international plans

- Coverage Limitations: May only cover care within the country of residence

- Language Considerations: Policy documents may be in the local language

4. Pay-As-You-Go (Self-Insurance)

In countries with very low healthcare costs, some expatriates opt to pay out-of-pocket:

- Viability: Only recommended in countries with extremely affordable healthcare

- Example Costs:

- Doctor visit: $20-50 in many countries

- Specialist consultation: $30-100

- Hospital stay: $200-500 per day (compared to $2,000+ in the U.S.)

- Risk Factor: Major emergencies could still be costly

- Best Combined: With a high-deductible catastrophic coverage plan

Healthcare Quality in Popular Retirement Destinations

Mexico

Strengths:

- Modern private hospitals in major cities

- Many U.S.-trained doctors who speak English

- Affordable prescription medications (often 50-80% less than U.S. prices)

- Easy access to specialists without referrals

Notable Facilities:

- Hospital Angeles (multiple locations)

- American British Cowdray (ABC) Hospital in Mexico City

- Hospiten network in tourist areas

Cost Examples:

- Primary care visit: $30-50

- Specialist consultation: $40-80

- Hip replacement: $8,000-12,000 (vs. $40,000+ in U.S.)

- Monthly cost for diabetes management: $50-100

Panama

Strengths:

- Johns Hopkins-affiliated Hospital Punta Pacífica in Panama City

- Medical tourism destination for complex procedures

- Many U.S.-trained physicians

- Excellent care in Panama City, more basic in rural areas

Notable Facilities:

- Hospital Punta Pacífica

- Centro Médico Paitilla

- Hospital Nacional

Cost Examples:

- Primary care visit: $40-60

- Specialist consultation: $50-100

- Coronary bypass: $15,000-25,000 (vs. $100,000+ in U.S.)

- Hospital room: $100-200 per day

Portugal

Strengths:

- High standard of care meeting European Union requirements

- Excellent public and private hospital networks

- Well-trained medical professionals

- Affordable private care even without insurance

Notable Facilities:

- Hospital da Luz network

- CUF hospitals

- British Hospital Lisbon

Cost Examples:

- Primary care visit (private): €50-80

- Specialist consultation (private): €80-150

- Hip replacement (private): €8,000-12,000

- Monthly cost for hypertension management: €20-40

Costa Rica

Strengths:

- CIMA Hospital affiliated with Baylor University Medical Center

- Strong medical tourism infrastructure

- Excellent tropical and preventive medicine expertise

- Affordable dental care of high quality

Notable Facilities:

- CIMA Hospital

- Hospital Clínica Bíblica

- Hospital La Católica

Cost Examples:

- Primary care visit: $50-80

- Specialist consultation: $70-120

- Cardiac catheterization: $4,000-6,000 (vs. $20,000+ in U.S.)

- Dental implant: $800-1,200 (vs. $3,000-5,000 in U.S.)

Prescription Medications Abroad

Availability

Most common medications are available internationally, though:

- Brand names may differ

- Some U.S. medications may not be available in identical formulations

- Certain controlled substances have stricter regulations

Cost Savings

Prescription medications are significantly less expensive in most countries due to:

- Government price controls

- Generic availability

- Different patent laws

- Absence of middlemen in distribution

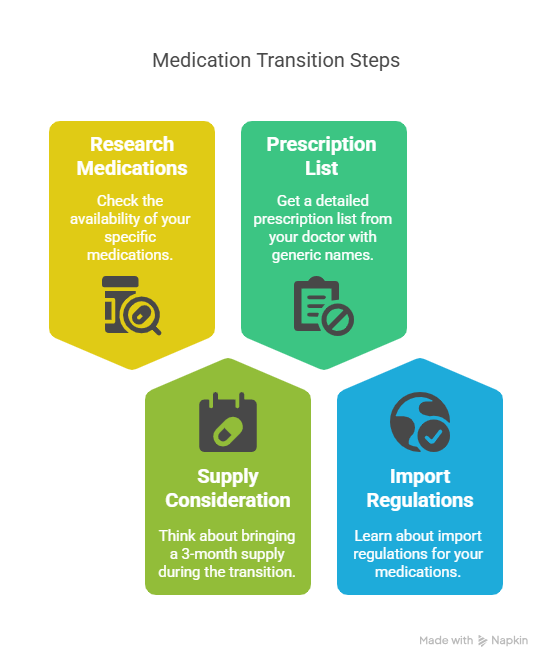

Practical Considerations

Before moving abroad:

- Research availability of your specific medications

- Consider bringing a 3-month supply during transition

- Obtain a detailed prescription list from your doctor with generic names

- Understand import regulations for your medications

Emergency Medical Evacuation Insurance

For serious medical emergencies, evacuation to a major medical center or back to the U.S. may be necessary:

- Standalone Policies: Companies like MedjetAssist and Global Rescue offer membership programs

- Included Coverage: Many international health insurance plans include evacuation benefits

- Cost Range: $300-600 annually for comprehensive evacuation coverage

- Importance: Critical for those in rural areas or countries with limited advanced care

Planning for Healthcare Needs: A Practical Approach

Step 1: Assess Your Health Profile

Before choosing an affordable healthcare abroad retirement destination, honestly evaluate:

- Existing medical conditions

- Medication requirements

- Mobility limitations

- Frequency of needed medical care

- Family health history

Step 2: Research Country-Specific Healthcare

For your target countries, investigate:

- Quality of care for your specific conditions

- Availability of specialists you may need

- Access to medications you require

- Climate considerations for health conditions

- Distance to major medical facilities

Step 3: Visit and Experience the Healthcare System

During exploratory visits:

- Schedule a check-up with a local doctor

- Visit potential hospitals

- Meet with expatriates to discuss their experiences

- Research local insurance options in person

Step 4: Develop a Comprehensive Healthcare Plan

Before moving, create a written plan including:

- Primary insurance coverage

- Secondary/emergency coverage

- Local doctors and facilities

- Emergency evacuation strategy

- Prescription medication plan

- Plan for U.S. care if needed

Special Considerations for Common Health Conditions

Heart Disease

- Mexico, Panama, and Costa Rica have excellent cardiac care centers

- Consider proximity to specialized cardiac facilities

- Verify availability of specific cardiac medications

- Check if your pacemaker/device can be monitored locally

Diabetes

- Verify availability and cost of insulin and supplies

- Research endocrinologists in your target location

- Consider climate impact on diabetes management

- Check coverage for diabetic complications

Arthritis

- Consider climate impact on joint pain

- Research availability of rheumatologists

- Check coverage for joint replacements if needed

- Verify physical therapy options

Cancer Survivors

- Research oncology follow-up capabilities

- Check screening technology availability

- Verify access to specific medications

- Consider distance to major cancer centers

Additional Affordable Healthcare Abroad Resources

Official Government Sources

- Medicare Coverage Outside the United States – Official Medicare information

- International Association for Medical Assistance to Travelers – Non-profit providing objective healthcare information

- Centers for Disease Control and Prevention – Travelers’ Health – Country-specific health information

Helpful Tools

- International Living Healthcare Ratings – Annual rankings of healthcare quality in retirement destinations

- Numbeo Healthcare Index – User-reported healthcare quality metrics by country

Related Articles on Affordable Retirement Abroad

- Yes, You CAN Afford to Retire Abroad – Our overview of affordable retirement options overseas

- Social Security Abroad: A Complete Guide for American Retirees – Understanding your benefits while living overseas

- Housing Abroad – Rent or Buy? A Guide for American Retirees

Conclusion

Healthcare concerns shouldn’t prevent you from pursuing an affordable retirement abroad. With proper research and planning, many American seniors find better, more attentive, and more affordable healthcare overseas than they experienced in the United States.

The key is approaching healthcare planning methodically: research thoroughly, visit facilities in person, speak with expatriates about their experiences, and develop a comprehensive strategy that addresses both routine care and emergencies.

Many of our readers report that healthcare quality was one of their biggest concerns before moving abroad—and one of their most pleasant surprises afterward. With costs often 50-80% lower than in the United States and doctors who typically spend more time with patients, healthcare abroad can be a highlight rather than a hindrance to your retirement adventure.

Have questions about healthcare options in specific countries? Contact us for personalized guidance on finding quality, affordable medical care in your target retirement destination.

Join Our Community Today

Get expert insights and exclusive tools to plan your affordable overseas retirement. Subscribe for our free newsletter. Just enter your email below: