Living Well on a Fixed Income

Imagine waking up to the sound of gentle waves lapping against a tropical shore, or the vibrant bustle of a Mediterranean market. You, like many American seniors living on Social Security or a small pension, are considering a move abroad for a more fulfilling and affordable retirement. Yes, the dream is tantalizing, but the key question about budgeting for overseas retirement lingers: “Can I truly live comfortably on a fixed income overseas?”

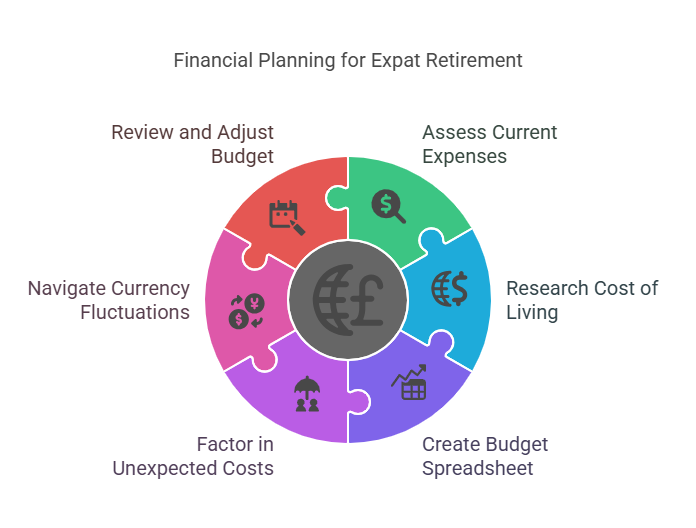

The answer is a resounding yes! However, budgeting for overseas retirement requires careful financial planning. Transitioning to expat life is an exciting adventure, and with a well-structured budget, you can ensure your financial security and enjoy every moment. This post will guide you step-by-step in creating a realistic budget, tailored to your Social Security or pension income.

Assess Your Current Expenses: Start with Honesty

Before you can even begin to imagine a budget for your new life abroad, you need to understand your current spending habits. Take a good, honest look at where your money goes each month. Start by listing all your essential expenses: housing, utilities, food, transportation, healthcare, and any recurring debts.

Now, identify areas where you can cut back. Are there subscriptions you no longer use? Can you reduce your dining-out expenses? Even small changes can make a big difference. This exercise will not only give you a clear picture of your current financial situation but also prepare you for the adjustments you’ll need to make when living abroad.

Research Cost of Living: Knowledge is Power

One of the most appealing aspects of retiring abroad is the potential for a lower cost of living. But how do you know if a particular destination is truly affordable? You need to do your research.

Start by exploring reputable websites that provide cost of living comparisons. Numbeo and Expatistan are excellent resources. These sites allow you to compare expenses such as housing, food, healthcare, and transportation between your current location and potential expat destinations.

Pay close attention to housing costs, as this is often the largest expense. Consider whether you want to rent or buy, and research average rental prices or property values in your desired area. Also, factor in the cost of healthcare, which can vary significantly from country to country.

Create a Budget for Overseas Spreadsheet: Your Financial Roadmap

Now, it’s time to create your budget spreadsheet. This will be your financial roadmap, guiding you through your expat journey. Start by listing your income sources: Social Security benefits, pension income, and any other sources of income.

Next, create categories for your expenses, based on your research and current spending habits. Include categories for housing, food, healthcare, transportation, entertainment, and miscellaneous expenses. Don’t forget to include a category for savings – even small amounts can add up over time.

There are many free spreadsheet templates available online. Choose one that suits your needs and customize it to your specific situation.

Factor in Unexpected Costs: Prepare for the Unexpected

Life is full of surprises, and even with the best planning, unexpected expenses can arise. That’s why it’s crucial to factor in a buffer for unexpected costs, such as medical emergencies, travel expenses, or unexpected repairs.

A good rule of thumb is to set aside at least 10% of your income for unexpected expenses. This will give you peace of mind and help you weather any financial storms.

Currency Fluctuations: Navigating the Global Market

When living abroad, you’ll be dealing with different currencies. Currency exchange rates can fluctuate, an important factor when budgeting for overseas retirement. To mitigate this risk, consider opening a foreign currency account in your expat country. This will allow you to hold funds in the local currency and avoid frequent exchange rate fluctuations.

You can also use online currency exchange services that offer competitive rates. Therefore, remember to monitor exchange rates and transfer funds when they’re favorable.

Uncomfortable with currency exchange risk? Some popular expat retiree countries, such as Panama and Ecuador, use the U.S dollar as their official currency.

Review and Adjust: A Living Document

Your budget for overseas retirement is not a static document. It should be reviewed and adjusted regularly to reflect your changing needs and circumstances. Review your budget at least once a month, and make adjustments as needed.

Don’t be afraid to make changes. In fact, if you find that you’re consistently overspending in a particular area, look for ways to cut back. So, if you’re consistently underspending, consider increasing your savings or allocating more funds to other areas.

Conclusion: When Budgeting for Overseas Retirement, Your Dream Awaits

With careful planning and a realistic budget, you can confidently embark on your expat adventure, knowing that your financial security is intact. Remember, the key is to be honest with yourself, do your research, and create a budget that works for you.

You can enjoy a comfortable and fulfilling expat life on a fixed income. The world is waiting, and with a little planning, you can make your dream a reality.

Related Articles on Affordable Retirement Abroad

- Yes, You CAN Afford to Retire Abroad – Our overview of affordable retirement options overseas

- Retirement Visas Explained – Your guide to living legally abroad

- Social Security Abroad – A complete guide

- Single vs Couple Retirement Abroad – A Guide for Solo American Retirees

- Healthcare Abroad – What American Seniors Need to Know

- Housing Abroad – Making the Right Housing Decision

Join Our Community Today

Get expert insights and exclusive tools to plan your affordable overseas retirement. Subscribe for our free newsletter. Just enter your email below: